If you answer ‘Yes’ to all three questions then you are truly a super investor.

- Are you happy with your savings up to date? Yes/No

- Can you be happy about the amount of money you have saved, based on the amount you are currently saving? Yes/No

- Have you envisioned an Investment plan in which you would save only for 5 years and enjoy benefits for 30 years? Yes/No

If not, invest in Nations Assurance Capital today!

- A fund for your children’s higher education

- A fund to purchase land

- A fund for your marriage

- A retirement fund to enjoy the sunset of your life

- A fund to buy your dream vehicle

- A fund to build your dream house

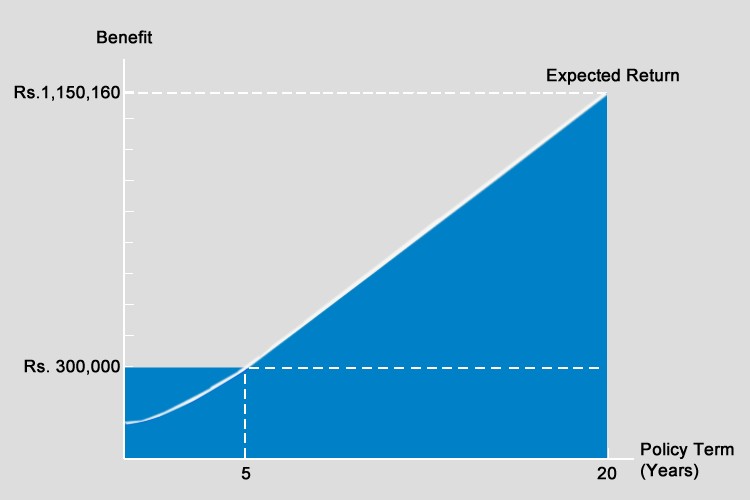

Example: The table below depicts the expected return at the end of 20 years, if you are 35 years old and paying a monthly premium of Rs. 5,000/- for 5 years.

|

Annual Premium (Rs.) |

The amount beneficiaries will be entitled to in the event of death (Rs.) |

Expected return at the end of 20 years |

||

|---|---|---|---|---|

|

Calculated at 6% Dividends (Rs.) |

Calculated at 8% Dividends (Rs.) |

Calculated at 10% Dividends (Rs.) |

||

|

60,000 |

300,000 |

602,357 |

837,892 |

1,159,160 |

|

Year |

Minimum Dividend rate guaranteed for the year |

Declared dividend rate |

|---|---|---|

|

2012 |

8 |

11.5 |

|

2013 |

9.5 |

11.75 |

|

2014 |

8 |

11.5 |

|

2015 |

8 |

9.5 |

|

2016 |

8 |

10.5 |

|

2017 |

10 |

10.25 |

|

2018 |

10 |

10 |

|

2019 |

10 |

10 |

In the event of an unexpected death, the amount your beneficiaries will be entitled to (investment account value as at the date of death or the Basic Sum Assured, whichever is higher).

Nations Assurance Capital is a product issued and underwritten by Nations Assurance Limited

In the event of an unexpected death, your beneficiaries will receive either the investment account value as at the date of death or the Basic Sum Assured, whichever amount is higher.

The minimum premium payments for

- Monthly: Rs. 5,000/-

- Quarterly: Rs. 13,000/-

- Half-Yearly: Rs. 24,000/-

- Annually: Rs. 40,000/-

- Complete premium payments in 5 years

- Policy can be obtained for any period between 10 and 30 years

- Basic Sum Assured is 5 times the Basic Annualized Premium

- Investment Account value will be paid as the maturity benefit at the end of the policy term

- Investment Account value as at the date of death or the Basic Sum Assured, whichever is higher, will be paid in case of death

- Minimum dividend percentage for a specific year will be declared at the beginning of each year

- You could also include the “Waiver of Premium Benefit” for this plan if required

- Option to make partial withdrawals after the 10th year of the policy

Issued and underwritten by:

Application Form

Get in touch